A Study on the Revitalization of the Automobile Tuning Components Industry

Copyright Ⓒ 2022 KSAE / 201-01

This is an Open-Access article distributed under the terms of the Creative Commons Attribution Non-Commercial License(http://creativecommons.org/licenses/by-nc/3.0) which permits unrestricted non-commercial use, distribution, and reproduction in any medium provided the original work is properly cited.

Abstract

Although the global automotive tuning parts market has already exceeded 100 trillion won, the domestic automotive tuning parts market is still small and has a rigid distribution structure with no active trading, adversely affecting the overall parts market and accelerating the economic downturn. Looking at the factors that hinder the development of the domestic automobile tuning parts industry, there are still strict regulations and systems, lack of technology development, lack of professional manpower, unreasonable distribution structure, lack of marketing, and difficulties in entering overseas markets. Therefore, it is necessary to derive the right direction for the development of the domestic automobile tuning parts industry and vitalization of the overall parts market through item-by-item analysis of countermeasures prepared to improve the unreasonable distribution structure of the automobile tuning parts market.

Keywords:

Comparison of domestic and foreign tuning parts market size and policies, Cost benefit, Economic effect, Local government revenue generation, A new alternative to the stagnant auto parts industry1. Introduction

In December 2013, the Ministry of Land, Infrastructure and Transport(“MLIT”) revised the “Regulations on Vehicle Structure and Device Changes” to expand1) that targets available for free tuning without approval from the Korea Transportation Safety Authority(“KOTSA”) in a bid to ease the domestic regulations related to automobile tuning. The term “automobile tuning” was registered as a legal term, as, in March 2016, the MLIT, in its Administrative Notice of Partial Revision(Draft) of 「Regulations on Vehicle Structure and Device Changes」, changed2) the existing term ‘change of structure and device’ to ‘tuning’.

Despite these efforts, the size of the car tuning market still exhibit a sizable difference between domestic and foreign countries. The size of the global car tuning market has already exceeded KRW 100 trillion. In contrast, the domestic car tuning market was reported at KRW 3.8 trillion as of 2018.

The size of the Japanese car tuning market was KRW 16 trillion as of 2018, which was about four times the size of the domestic market.3) Apart from a difference in the characteristics of the automobile industry by country, such market situation indicates that our automobile tuning parts market is very rigid. Currently, the entire automobile industry is facing a new paradigm due to the issue of carbon neutrality along with an increase in the share of eco-friendly vehicles, so all related parts industries are required to undergo a market change.

In automobiles, the lifespan of consumables is gradually increasing due to the improvement of parts quality and the development of control systems. Light maintenance companies, which were mainly engaged in maintenance-related work, are facing a poor business situation with a sharp decline in sales. As it is foreseen that the maintenance-related business market will shrink in the future, there is concern about the shrinkage of the auto parts industry.

On October 14, 2019, the MLIT notice ‘regulations on vehicle modification’ were revised, resulting in easing of 27 modification regulations.4) However, this actually did not meet the expectations of consumers. Car modification is still difficult for consumers to feel, and the content is mainly aimed at specific enthusiasts.

Even if expensive auto-modification parts are attractive enough, it is difficult to expect a major development in the market because the enthusiasts who consume them form a small market in the auto-modification parts sales category.

It is of course necessary to supplement the system for the automobile modification industry to develop further. A correct understanding of the domestic automobile modification market has not been established. There was also a phenomenon of fairly improvised content development bias without deep thought about what consumers want or what they are drawn to.

For example, there were times when content related to dress-up tuning dominated most of the automobile modification field of motor shows. At one time, due to the issue of campers, the booths of motor shows were filled with camper contents. Of course, it was enough to stimulate curiosity about car modification. However, it could not quench the enthusiasts’ thirst for the essence of modification. The environment has continued in which many people who are expecting the development of the automobile tuning market in Korea cannot easily approach the essence of automobile tuning.

The expansion of the automotive tuning parts market is clearly an attractive category, but currently, Korea’s general automobile parts market is experiencing a decline even in sales of OEM parts due to external and domestic economic stagnation. The market share is being reorganized through the activation of replacement certified parts or remanufactured and reformed parts.

Consumer demand is to prefer the same or comparable quality to OEM part performance while paying less. Producers are also making efforts to develop technologies to secure intermediate profits by lowering production costs while meeting the needs of consumers. This is because the automobile tuning parts market should basically reflect the elements of improvement from the existing performance. If it does not reflect the appeal as content that can satisfy the needs of consumers, it will be ignored by consumers.

This study seeks to identify the size and current problems of the automobile tuning parts market in Korea. Based on the analysis of each method that can solve the impediments to the development of the automobile tuning parts market, it presents a new alternative to address the stagnant automobile parts industry in order to properly lead the revitalization of the domestic automobile tuning parts market.

2. Analysis of Domestic and Foreign Automobile Tuning Parts Markets

Chapter 2 compares the size of the domestic and foreign automobile tuning market and the policy characteristics of each foreign country. Among the problems of the domestic automobile tuning market, impediments to market development are analyzed and possible improvement measures are deduced.

2.1 Analysis of the Global Major Car Tuning Market Size

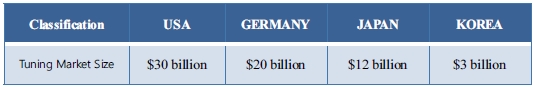

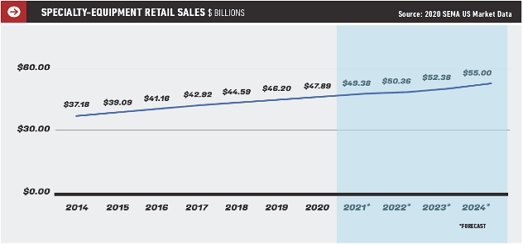

As shown in Fig. 1, the size of the car tuning market before the COVID-19 pandemic was KRW 39 trillion in the United States, KRW 26 trillion in Germany, KRW 16 trillion in Japan, and KRW 3.6 trillion in Korea. The size of the global tuning market has been steadily increasing despite the COVID-19 pandemic. As shown in Fig. 2, according to the SEMA report, the US market, which is the largest tuning market, continued its growth trend with an all-time high of USD 47.89 billion in 2020.5)

However, since the domestic tuning market has a very small market size and sales performance compared to the global automobile tuning market, there is an urgent need to prepare measures to revitalize the market.

2.2 Analysis of the Current Domestic Automobile Tuning- related Market Size and the Need to Improve Distribution Structure

The automobile tuning market is largely divided into core industries and related industries. The core industries are divided into manufacturing and service industries, while the service industry is the automobile structure/device change service industry, which is the secondary market of the core industry related to automobile tuning.

To classify the primary and secondary markets, the manufacturing industry belongs to the primary market, the before-market, while the sales and service industries belong to the secondary market, the after-market.

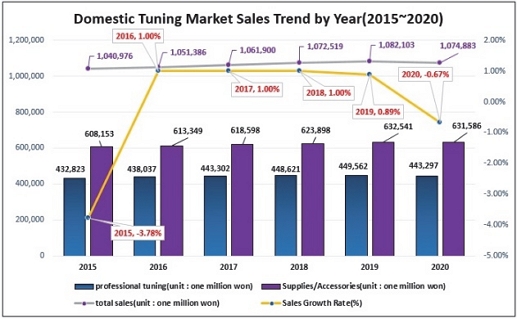

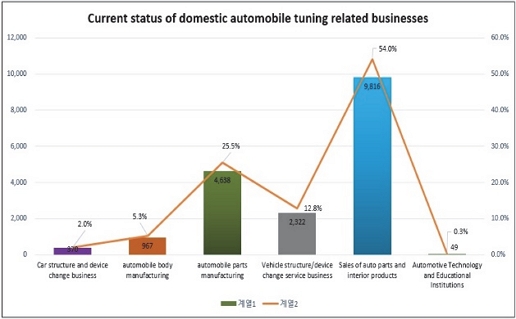

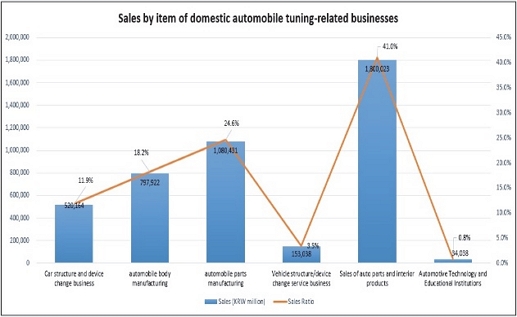

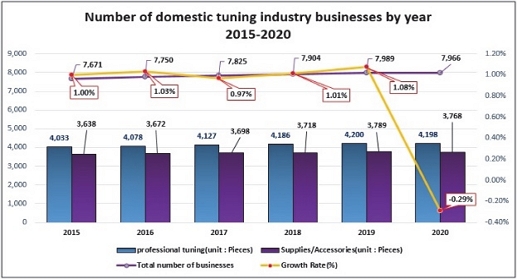

When analyzing the industry with the largest market share based on the number of businesses that can be identified from the results shown in Fig. 4 along with the sales size of the domestic automobile tuning market by year shown in Fig. 3, the domestic tuning market sales increased at an average annual rate of 0.64 % compared to 2015. The sales settlement in 2020 shows a decrease of -0.67 %(KRW 72.2 billion) compared to the previous year. The industry with the largest market share is the auto parts and interior product sales sector, with a market share of about 54 %.

In addition, the automobile parts manufacturing industry occupies second place, accounting for about 25.5 %.

Looking at the graph, the current domestic automobile tuning market mainly consists of simple parts sales focused on dress-up tuning and sales of interior parts rather than actual structural device changes for performance improvement. In fact, the numbers also indirectly prove the lack of professional manpower in the field and the lack of composition by content, which are problem areas in this industry.

The status by sales type in Fig. 5 illustrates this: total sales related to car tuning are about KRW 4.386 trillion. Sales of automobile tuning parts and interior products are about KRW 1.8 trillion. The automobile tuning accessory manufacturing industry is about KRW 1.8 trillion.

The value of the automobile tuning body manufacturing industry is about KRW 800 billion. Automotive structural equipment change business(manufacturing sector) is about KRW 520 billion. Vehicle structural equipment change service business(service sector) is KRW 150 billion. The automobile technology and training industry is worth KRW 34 billion. It was thus confirmed that the service industry (service industry field) for the automobile structural system change service industry was not active.

In the car tuning market, the category that can be felt activated by consumers is the secondary market, the after-market sector, so a realistic increase in sales will appear only when transactions in the service-related industries in the automobile maintenance market are actively conducted. Based on that, the vision of the automotive tuning industry can be recognized.

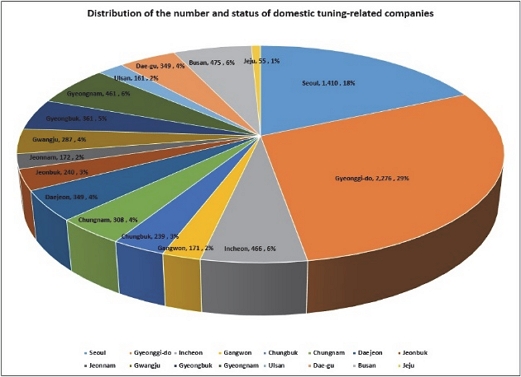

In Fig. 6, the current status of domestic automobile tuning-related businesses is summarized in the form of a distribution chart for each metropolitan city and each region.6) A look at the distribution map of tuning-related businesses indicates that they are concentrated in Seoul, Gyeonggi and metropolitan cities rather than being evenly distributed in each region.

2.3 Analysis of the Environmental Characteristics of the Overseas Automobile Tuning Market

Why the development rate is slow, especially in the service sector, needs to be examined. First, it is worth comparing and analyzing the scope of overseas regulations and market environmental factors.

As shown in Table 1, the United States does not have separate regulations for car tuning parts, but the tuning tolerance range is free within the range that does not impair the environment and safety compliant with FMVSS. Information on product quality is provided by quality assurance in connection with automobile tuning insurance and SAE(Society of Automotive Engineers) mark. The National Highway Traffic Safety Association(NHTSA) under the Department of Transportation(DOT) protects consumers’ rights and interests by testing the products for use in the United States.

The core of the US automobile tuning industry is ‘guaranteeing consumers’ freedom of choice’ and promoting ‘reliability that consumers can rest assured through appropriate insurance linkage’, thereby revitalizing the automobile tuning market.

As shown in Table 2, Germany and the UK representing Europe, have stricter certification standards for automotive tuning parts than for OEM parts, and they manage certification through certification agencies such as TUV.

These operate a separate automotive tuning parts certification system. Automotive tuning parts certified according to UN Regs(UN Regulations) and EEC Regs (European Community Regulations) can be used. In Germany, automotive tuning parts approved by KBA according to StVZO can also be used.

Automobile ABE(General Operation Approval for Auto Parts), ABG(General Approval for Parts), and TGA (Conformity Approval) should be complied with. The reason for such strict regulation is to secure reliability for consumers. Assuming that certified parts are installed, the tolerance for tuning is similar to that of the US, and the UK has the world’s top-class motorsports industry and clusters worth about $6.4 billion.

The core of the UK and German car tuning industry is to prioritize “securing reliability that allows consumers to feel safe through a strict pre-certification system that guarantees consumer safety”. In the case of finished cars, manufacturers operate a tuning subsidiary to secure consumer trust from the production stage. In particular, the UK is revitalizing the automobile tuning market as the world’s largest motorsports cluster while possessing the world’s best motorsports business.

As shown in Table 3, domestic technology and safety standards(security standards) in Japan shall apply within the scope of general structural change(remodeling). Autonomous standards are more strictly managed and certified by private organizations to gain consumer trust. Under the leadership of NAPAC, strict standards are applied to car tuning reports.

If not subject to an automobile tuning report, the association independently operates its own standards and test methods and perform private certification by issuing its own certificates.

The core of Japan’s car tuning industry is revitalizing the car tuning market by promoting “a market environment in which consumers can access car tuning more easily and comfortably through strict private autonomous certification,” while “guaranteeing consumers’ free choice” like the United States.7)

3. Analysis of Problems and Solutions in the Domestic Automobile Tuning Industry

As part of the 2020 MLIT research project, a survey was carried out on the auto parts certification system and market status to identify factors hindering the development of the domestic car tuning industry. A survey and analysis were conducted on 120 companies engaged in parts manufacturing and car tuning-related industries via participation in research forums and e-mails, etc.8)

This chapter analyzes the ranking of such factors impeding development and their solutions to clearly organize the needs of the industry and consumers. It verifies that the development of the automobile tuning industry will play a role as a new alternative in boosting the automobile maintenance market in a recession as well as the growth of the automobile tuning parts industry.

3.1 Ranking of Impediments to the Development of Automotive Tuning Industry

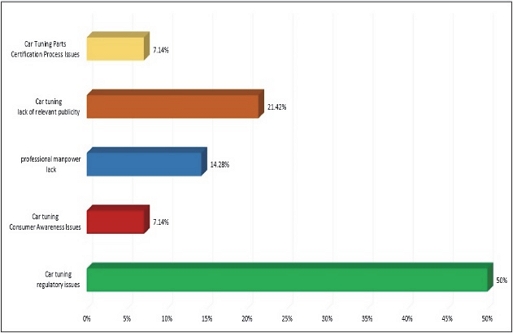

As shown in Fig. 7, the top factor pointed out as the biggest problem in the development of the automobile tuning industry remains the difficult tuning regulation system.

The second factor is the lack of publicity marketing, the third factor is the lack of professional manpower, and the fourth factor is the problem of negative consumer perception. Although these deterrent factors have been alleviated more than before, the real demand in the field involves realistic tuning deregulation that can help revitalize the development of various contents.

In the structural change approval, there are still many difficult items to determine which parts require approval or which parts do not, so it is not easy to create and apply a system for each of so many items. It is necessary to develop the tuning parts certification system more efficiently and to make automatic structural change approval by classifying the installation of certified parts alone as minor tuning. By granting follow-up management responsibility to installation companies, the trust of consumers must be secured.

In the case of tuning work to improve the performance and safety of products in the insurance sector, it should be included in the special terms and conditions for discounts on premiums. In case of repairs due to accidents or maintenance and repair, an environment should be prepared so that the use of certified tuning parts can be revitalized by related companies.

3.2 Analysis of the Current Status of Training Institutions for Car Tuning Specialists

As shown in Table 4, despite the fact that automobile-related educational institutions are evenly distributed by size and region, there are only five automobile tuning-related university-level specialized educational institutions in Korea. Thus, it is necessary to promote the environment of professional education by reorganizing the university’s curriculum.

3.3 Growth Prediction Survey and Analysis of the Domestic Tuning Market by the Automobile Tuning Parts Certification System

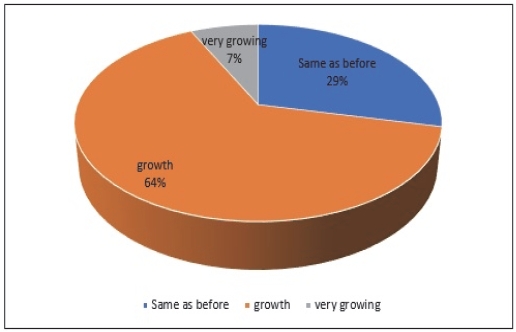

As shown in Fig. 8, the majority made a positive response to the automotive tuning parts certification system, but 29 % responded that the existing situation should be maintained.

The fact that only 7 % responded that the system has developed very much means that the perfect trust in the system is still not realistic for consumers, and this is due to negative perceptions about car tuning.

In addition, even those in the field know that the tuning parts certification system must be thoroughly managed, but the system remains underdeveloped because it requires further improvement of procedures and regulations. It also requires a computer network optimization base that can perform follow-up management.

Based on KOTSA’s survey of the general public, 63 % of the respondents thought that car tuning was illegal, while 17 % expressed concerns about safety issues. This indicates the consumers’ deep negative perceptions about car tuning.

4. Importance of Eradication of Illegal Distribution for the Development of Automobile Tuning Parts Industry and Solutions

Illegal distribution of car tuning parts is the biggest obstacle to improving the market’s systems and is causing the biggest obstacle to securing customer confidence in consumption.

The most important solution is deemed to present guidelines through system improvement and create a market environment that can correct itself. It is intended to try a new desirable alternative to the stagnant automobile maintenance market. Also, using the right alternative will conversely activate the distribution of the parts market. Establishing a healthy market culture free from illegal distribution can infuse new vitality in the entire automobile industry.

4.1 Effect of Improving Automobile Safety Performance through the Eradication of Illegal Tuning Parts Distribution and the Importance of Follow-up Management

Illegal car tuning does not aim to improve basic performance and causes indirect and direct concerns about the safe operation of cars.

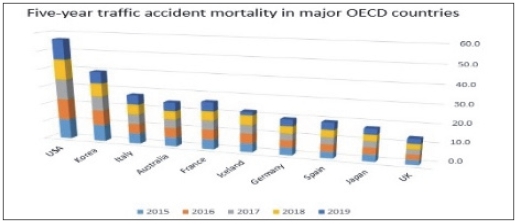

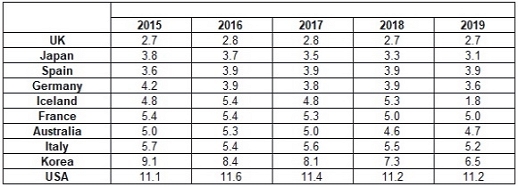

As shown in Table 5 and Fig. 9, in the five-year mortality rate for road traffic accidents in major OECD countries, Korea holds the infamous second place after the United States.9)

In particular, a safety defect caused by illegal tuning of a vehicle can be even more fatal in the event of a vehicular accident.

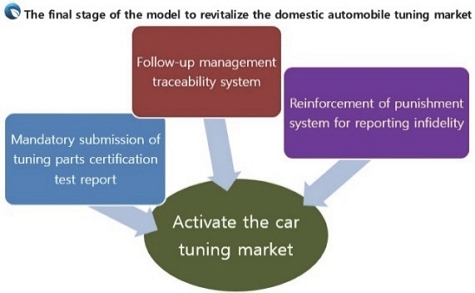

As shown in Fig. 10, in order to ultimately trigger the vitalization of the automobile tuning market, it is necessary to create an environment in which the market can purify itself through the presentation of clear guidelines from the institutional system.

The key points are summarized as follows: efficient management of the traceability system should be implemented; submission of tuning parts certification test reports to the governing body should be mandated; in the case of product defects, if insincere reporting is found, punitive measures should be strengthened. With these measures, it is necessary to meticulously manage the tuning practice from the product development stage and create an environment in which the market can self-correct itself.

5. Overview of Domestic Automobile Tuning Companies and their Economic Management

This chapter presents an analysis of the number of domestic automobile tuning-related companies and the current status of employees by year. In order to improve the operating profit of domestic automobile tuning companies, it provides an analysis of factors of increase in cost-benefit, which are factors that increase the cost of automobile tuning parts. It also identifies the need for cost-benefit improvement to create a virtuous cycle market structure that leads to an increase in the number of companies and employees.

5.1 Number of Domestic Car Tuning Companies and Workforce Size

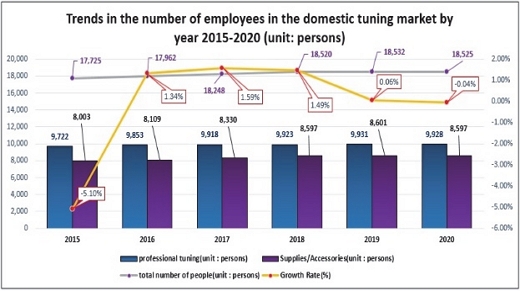

As shown in Figs. 11~12, from 2015 to December 2020, there were 7,966 companies in specialized tuning and tuning of supplies and accessories in Korea. These companies had 18,525 employees in their roster.10)

Due to the impact of the COVID 19 pandemic, the number of companies specializing in car tuning and the number of employees decreased slightly. The market size will gradually increase as the global car tuning market resumes its growth. In order to revitalize the automobile maintenance market, it is necessary to minimize the operating cost of the companies, realize the cost of tuning parts and labor, and improve the operating profit.

5.2 Economic Effect of Automobile Tuning Parts Industry through Cost-Benefit Improvement

As the distribution structure of the automobile tuning parts industry improves, customer convenience increases and unnecessary expenses are accordingly reduced, thereby resulting in cost savings.

Social benefits generated by strengthening the certification system include parts certification-related fees, composition costs obtained from computer system operating costs, and structural change inspection fees.

If the costs for equipment and facility investment including testing equipment for initial certification facilities are excluded, it is expected that there will be no significant increase in the cost of testing and certification facilities in the future, since only maintenance costs such as regular equipment quality inspection are required. However, as the number of certification items increases, the cost increases due to the addition of test equipment or increased inspection items. Yet, improvement of the parts certification system is essential, and certified parts that customers can trust will alleviate the follow-up burden of the after-market and further increase customer trust and satisfaction.11)

The cost-benefit ratio is mainly used when analyzing the feasibility of public investment projects. As the distribution structure improves and costs decrease, the benefit ratio becomes higher.

Therefore, to further boost the development of the tuning parts industry, it is necessary to increase the environmental construction of certification testing institutions and clusters. Since this is done through government-funded projects, high-value-added technology should be secured to minimize the ratio of facility cost and parts production cost in order to improve the benefit value compared to the initial cost. Measures should also be determined to improve the benefits through the simplification and efficient management of the certification process.

In conclusion, the ratio of total benefits converted to present value divided by total costs should be improved so that 1 or higher can be obtained to enhance the economic value of the automobile tuning industry.

6. Conclusion

- 1) Compared to the size of the global tuning market, the domestic automobile tuning market has a very small position, and there is an urgent need for a revitalization plan along with system improvement.

- 2) Results of the analysis of the current domestic automobile tuning-related market size and distribution structure confirmed that the automobile structural equipment change service business(service sector) is not active. To revitalize the automobile tuning market, it is very important for the secondary market, the after-market, to actively trade in related industries so that consumers can feel market vigor.

- 3) It is very important to analyze the advantages of the overseas automobile tuning market environment to improve the distribution structure of the domestic automobile tuning parts industry. The common factor is that they gain trust by protecting consumers’ rights and interests, providing a variety of choices, simplifying the parts certification process, while maintaining autonomous and strict management.

- 4) One of the factors hindering the development of the domestic automobile tuning market is the lack of relevant infrastructure. It is also necessary to expand machining centers and test/evaluation facilities to foster independent small-scale, high-value-added industries.

- 5) As in the case of Europe, a strict pre-certification system that guarantees consumer safety should be established more systematically in a private autonomous environment. Professional companies that handle only certified parts should be revitalized further, while simultaneously clarifying follow-up management.

- 6) In order to eradicate illegal tuning, it is necessary to improve the mandatory submission system for automobile tuning parts certification test reports. In the event of a defect, strict punitive responsibility should be accounted for. Therefore, from the development stage to follow-up management, parts developers create a virtuous cycle system, on their own, that creates a voluntary market environment in which the parts developers themselves come up with improvement plans. This will improve customer trust and revitalize the market.

- 7) The improvement of the distribution structure of the automobile tuning parts industry will not only revitalize the automobile tuning market, but also lead to a balanced development of the local economy as well as a new alternative to improving the after-market during recession. The cost-benefit ratio will improve with the establishment of an efficient system.

Acknowledgments

This thesis came out in 2022 as a result of the completion of the research project(P151400009) for the establishment of a tuning parts verification platform and EV conversion KIT, with funding from Joogbu University, under the management of the Korea Automotive Research Institute (KATECH), and hosted by the Ministry of Trade, Industry and Energy and Korea Institute for Advancement of Technology.

References

- Ministry of Land, Infrastructure and Transport Relaxes Regulations on Activation of Car Tuning http://www.molit.go.kr/USR/NEWS/m_71/dtl.jsp?lcmspage=105&id=95073237, , 2021.

- Administrative Otice of Partial Revision (Draft) of 「Regulations on Vehicle Structure and Equipment Changes」, https://www.molit.go.kr/USR/law/m_46/dtl.jsp?r_id=4521, , 2020.

- Korea Transportation Research Institute, Changes in Automobile Policy Conditions and Future Prospects, Presentation, 2021.

- Ministry of Land, Infrastructure and Transport Notification No.2019-574, October 14, 2019.

- 2021 SEMA Market Report, https://www.sema.org/news-media/magazine/2021/09/2021-sema-market-report-2, , 2021.

- Korea Transportation Safety Authority, Status Analysis and Prospect of Tuning Industry, 2020.

-

D. H. Kim, I. H. Kim, Y. I. Kim, Y. D. Kim and H. K. Kim, “Research on Improvement of Car Tuning Inspection and Management Plan,” Transactions of KSAE, Vol.28, No.3, pp.179-185, 2020.

[https://doi.org/10.7467/KSAE.2020.28.3.179]

- Korea Transportation Safety Authority Research, Automobile Parts Certification System and Market Status Research, 2020.

- National Indicator System OECD Major Countries Road Traffic Accident Mortality Survey, http://www.index.go.kr/unify/idx-info.do?idxCd=4261, , 2020.

- KATMO, Future Car Tuning Parts Technology Development Project_Automotive Tuning Industry Status Survey, 2019.

- S. Y. Ha, “Tuning Parts Certification System and Activation Plan,” KSAE Spring Conference Proceedings, pp.1111-1121, 2015.